SMALL BUSINESS OWNER?

A NEW FILING REQUIREMENT MIGHT APPLY TO YOUR COMPANY.

November 25, 2024

DEAR MEMBERS,

A bipartisan law, passed to protect U.S. economic and national security, requires many small businesses to report beneficial ownership information (BOI) to the U.S. government about the real people who control them.

Many companies in the United States will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the company. They will have to report the information to the Financial Crimes Enforcement Network (FinCEN).

If there have been any changes to your beneficial ownership information, please notify us within 30 days and provide the necessary documentation to update our records. Failure to do so may result in service interruptions.

WHAT IS THE FINANCIAL CRIMES ENFORCEMENT NETWORK (FINCEN)

FinCEN is a bureau of the U.S. Department of the Treasury. The Director of FinCEN is appointed by the Secretary of the Treasury and reports to the Treasury Under Secretary for Terrorism and Financial Intelligence. Click here for more information.

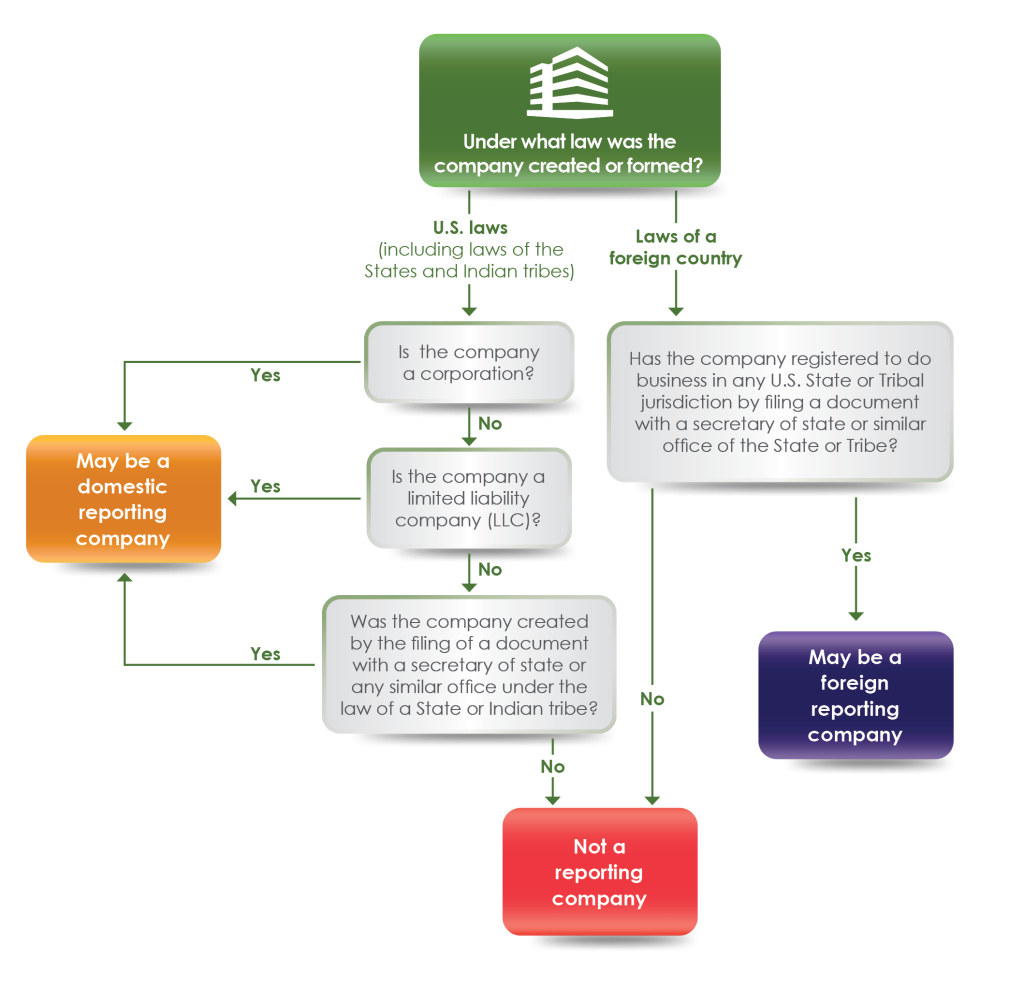

There are two types of reporting companies:

Domestic reporting companies are corporations, limited liability companies, and any other entities created by the filing of a document with a secretary of state or any similar office in the United States.

- Foreign reporting companies are entities (including corporations and limited liability companies) formed under the law of a foreign country that have registered to do business in the United States by the filing of a document with a secretary of state or any similar office.

There are 23 types of entities that are exempt from the reporting requirements. Carefully review the qualifying criteria before concluding that your company is exempt.

(FinCEN’s Small Entity Compliance Guide for beneficial ownership information reporting includes the following flowchart to help identify if a company is a reporting company.)

Currently these entities will have access:

- – Federal Officials

- – State & Local Officials

- – Tribal Officials

- – Financial Institutions

FinCEN will work closely with those authorized to access beneficial ownership information to ensure that they understand their roles and responsibilities to ensure that the reported information is used only for authorized purposes and handled in a way that protects its security and confidentiality.

FinCEN has prepared an extensive list of Frequently Asked Questions (FAQs) in response to inquiries received relating to the Beneficial Ownership Information Reporting Rule and Beneficial Ownership Information Access and Safeguards Rule. Visit their official site to learn more.

If you have any additional questions regarding your beneficial owner status, please refer to FinCEN’s Website or contact your tax provider for additional information. Please feel free to contact a Member Service Representative at 605-857-3489 for additional assistance.

Additional Resources:

This advertisement is explanatory only and does not supplement or modify any obligations imposed by statute or regulation. For additional information, please see www.fincen.gov/boi to learn more. Copyright © 2024 Financial Crimes Enforcement Network (FinCEN), U.S. Department of the Treasury. Version 1.0 — Published July 2024